Day Trading Guide

Zero commission fees for stock and ETF trades; zero transaction fees for over 3,000 mutual funds; $20 annual service fee for IRAs and brokerage accounts unless you opt into paperless statements; robo advisor Vanguard Digital Advisor® charges up to 0. In a period in which the market is flat, moving sideways, and just wiggling around, day trading might have the advantage. Finally, don’t assume that an exchange is available in your country, or even state, just because you can access its website. The choice of indicators should also be based on the options’ distinctive features. So, you get delivery of the shares you bought while the shares you sold move out of your Demat account. The rules that can be applied are virtually limitless. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Your quest is over if you’re looking for some profitable small company concepts. SEB offers algorithms on our own platform, Trading Station, and on a few external platforms. The stock exchange may change, alter, or even announce a new holiday in advance via a separate circular.

Types of Trading – Pick Your Style

Finding alpha is a challenging task. Overlooking Security Features. Paul Tudor Jones, one of the greatest traders in history, has this quote above his desk. Intraday power trading refers to continuous buying and selling of power at a power exchange that takes place on the same day as the power delivery. That may not sound like a lot, but, assuming consistent returns, it could amount to earning $170,000 more if an insider traded $1 million over several months. I’m just a regular guy who makes a living day trading Emini futures full time. Risk represents the possibility of monetary loss. Yet, some day traders might consider these smaller fluctuations “tradable. Receive alerts/information of your transaction/all debit and other important transactions in your Trading/ Demat Account directly from Exchange/CDSL at the end of the day. An IPO is when a private company begins trading on a stock exchange, and therefore becomes a public company, and open to the public to invest in by buying shares in the company. TD Ameritrade features accounts with no recurring fees and no minimum balance. ” Taylor and Francis Group, 2023. This lets profits run but ensures https://www.pocketoptionguides.guru/ you are stopped out with small losses if the trade reverses against you. Hundreds of markets all in one place Apple, Bitcoin, Gold, Watches, NFTs, Sneakers and so much more. It is identified by the last candle in the pattern opening below the previous day’s small real body.

Pros and Cons of Trading Forex

Don’t use money that’s earmarked for near term, must pay expenses such as a down payment or tuition. Plus, there’s a huge range of educational resources to learn more about trading. Buying and trading cryptocurrencies should be considered a high risk activity. Due to the wide range of market participants, including central banks, financial institutions, corporations, hedge funds, and individual traders, exchange rates change by the second so the market is constantly in flux. Here, an investor buys both a call option and a put option at the same strike price and expiration on the same underlying. Leverage can be another reason to trade with derivatives. Robinhood can be an excellent choice for users seeking a platform that allows both stock trading and the purchase of popular cryptocurrencies like Bitcoin and Ethereum within a single app. No, I have never done that. I hope you find this information educational and informative. Available in 490+ locations across 190+ countries, our hand picked Classroom venues offer an invaluable human touch. Bajaj Financial Securities Limited may have proprietary long/short position in the above mentioned scrips and therefore should be considered as interested. They master techniques that allow them to capitalize on brief fluctuations in price—buying when they think it will increase and shorting when they think it will fall. 486026 issued by the FMA in New Zealand and Authorised Financial Services Provider 47546 issued by the FSCA in South Africa. Investors who consider using the double bottom as part of their technical analysis will need to grasp concepts like support and resistance to properly identify the pattern. “Investments in securities market are subject to market risk, read all the scheme related documents carefully before investing. Depository Participant : Religare Broking Limited RBL NSDL: DP ID: IN 301774 SEBI Regn. For example, a 200 day MA requires 200 days of data. These assets span the domains of stocks, indices, commodities, and currencies.

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-04-9b163938fd4245b0a9cb34d1d0100136.jpg)

Pros and cons of algorithmic trading

More on that in the next section. Forex trading is the buying and selling of currencies on the foreign exchange market. While beginners cannot or do not have to use or even pay attention to IB’s advanced features, they are representative of the platform as a whole. Long term Investments. If you had risked 1% of your account balance on each trade, you would have ended the month with a 2% profit. Before launching his own firm in 2018, Thanasi served as the executive vice president and senior wealth advisor at Pathlight Investors while the company oversaw $300 million of individual and family assets. Learn how to trade binary options. Le trading de CFD est disponible dans les juridictions dans lesquelles CMC Markets est enregistré ou dispensé d’enregistrement, et dans la province de l’Alberta, il est uniquement disponible pour les investisseurs qualifiés. Com is an independent comparison platform and information service that aims to provide you with information to help you make better decisions. An even better Emini “continuous” contract symbol to use. In the high speed realm of options trading, grasping and utilising the best indicators can greatly influence your trading success. The tick size is the smallest increment/reduction of price movement possible. Our website offers colour trading apps you can easily download and install. You’d lose $400 8 points x $50 – excluding any other charges – if you were to close the position at the new sell price of $1,802. However, a certain level of risk is involved because traders look to profit from the quick price movements, which could just as quickly move against them. It looks like this on your charts. To avoid forex scams, you should only use regulated banks and brokers that are properly licensed to offer forex trading services in your country of residence. So to further his point, begin tracking your successes and failures alike. Thus, the closing time of the evening session extends to 11:55 PM. These markets can also help you to mitigate your risk by hedging your weekday trades against a weekend position on the same market. A bearish pennant is a small symmetrical triangle that forms after a sharp downward move. Double Bottom’s are one of the most relied patterns that exist out there. Victor Sperandeo, also known as “Trader Vic,” shares his trading knowledge in “Trader Vic 2” as a guide to a spectrum of trading strategies, risk management techniques, and a mindset for consistent success in the markets. Obligation: Futures represent a commitment to trade that must be squared off at the specified date. These financial items are compared and result in a comparison of the gross profit. A position can be traded up to 30 minutes prior to delivery. Unlock your potential with The Knowledge Academy’s Stock Trading Masterclass Trading Training in Stockholm, accessible anytime, anywhere on any device. The net option premium for this straddle is $10.

For which type of trader candlestick patterns work the best?

Breakaway gaps form at the start of a trend, runaway gaps form during the middle of a trend, and exhaustion gaps form near the end of the trend. The broker also accepts clients from dozens of countries. There are several options to choose from which is great for DIY investors. In summary, risk management is a crucial aspect of AI trading. The second candle is a doji which represents the indecision of the market participants and also shows that the buying pressure has slowed down. What is the quota for currency conversion. BSE and National Stock Exchange of India Ltd. Scalping is liquidity provision by non traditional market makers, whereby traders attempt to earn or make the bid ask spread. Comes with TFC feature. Write the word/phrase/term, which can substitute the following sentence. Maybe you believe in rsi indicators maybe you don’t.

Bearish

The above figure shows an example of a big W chart pattern. » Need to back up a bit. Options are complex instruments that can play a number of different roles within an investment portfolio, from helping investors manage risk to increasing income from current stock holdings. For full details of our fees please refer to our rates schedule. A typical swing trading strategy involving MA indicators sees traders hunt for ‘crossovers’ between two MAs. When selling puts with no intention of buying the stock, you want the puts you sell to expire worthless. Frank Richmond’s Options Trading Crash Course is an excellent choice if you are not entirely familiar with the options trading terminology. To sell a currency pair means that you expect the price to fall, which would happen if the base currency weakened against the quote. “As a long term investor, I don’t want a lot of noise in my investing app. Suppose a trader follows these simple trade criteria. Dipen Pradhan is a Staff Reporter for Forbes Advisor India. Scalping schemes involving social media stock promoters have become a significant focus of both civil and criminal enforcement in the United States in recent years as the use of Twitter and other social media networks has allowed online stock promoters to tout stocks and then sell them on their followers after their stock promotion campaigns cause a spike in the share price. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands. When you’re ready, you can upgrade to the live account with us. So look this list over carefully or you might miss something 🙂. Bearish continuation candlestick patterns show that sellers are still in control after a downward movement.

Interactive Brokers

Let’s look at an example. “Judgement Day: Algorithmic Trading Around the Swiss Franc Cap Removal,” Pages 24 25. The app lacks mutual funds, bonds, and other investment types. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. We shall Call/SMS you for a period of 12 months. This involves an examination of past price patterns and various indicators as a means to forecast upcoming price fluctuations. The trading platform offers conveniences such as the quick roll feature, which allows you to roll your option position into the next expiration cycle with a simple right click. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. With high volatility in these markets, this becomes a complex and potentially nerve wracking endeavor, where a small mistake can lead to a large loss. Day traders exercise discipline and patience, waiting for favorable trading conditions to align with their strategies. Crabel has had some influence on technical analysis, and he often suggested that day traders are social psychologists with a computer program. Learn About Our Expert Contributors and Analysts. Select “Manage consent” to manage your consent preferences. Day trading intraday trading envisages, as it follows from the name, execution of dozens of trades during one day on the basis of the technical analysis and complex chart systems. Privacy practices may vary, for example, based on the features you use or your age.

Search for an answer or browse help topics to create a ticket

Especially when growing. XTB also scores highly for its educational resources, including webinars, market analysis, and tutorials, which are invaluable for traders looking to improve their skills. Most probably the answer will be ‘no’. Here’s an example of a chart showing a trend reversal after a Morning Star candlestick pattern appeared. Measure advertising performance. Its broker dealer subsidiary, Charles Schwab and Co. Read full disclaimer here. Zero commission trading is when a broker doesn’t charge fees for executing a trade. More ways to contact Schwab. Past performance evaluations will assist you in making better trading judgments in the future. High frequency funds started to become especially popular in 2007 and 2008. Here’s how to protect yourself. Click here for our full Risk Disclosure. Make your money go further with unlimited commission free trades, fractional shares, and interest on uninvested cash. On the other hand, a bearish crossover occurs when the price of a security falls below these EMAs. Day traders generally use leverage such as margin loans. Reddit and its partners use cookies and similar technologies to provide you with a better experience. For most individuals, long term, diversified investment strategies remain a more reliable path to financial growth. Instead of searching, ask the AI.

Legal

Reddit and its partners use cookies and similar technologies to provide you with a better experience. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill that could potentially supplement your longer term investments. A trader can earn interest on the long currency and pay interest on the short currency when keeping a position from one trading day to the next. Deposits are not covered by the Isle of Man Depositors’ Compensation Scheme and terms and conditions apply. What is Options Trading. Best for: Active day traders ONLY who prefer NinjaTrader’s interface, functionality, and features over TradeStation. The Mat Hold pattern is a candlestick formation that signals a continuation of the prevailing trend, typically occurring in the middle of an uptrend or downtrend. The disclosures of interest statements incorporated in this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. Forewarned is fore armed. Share market works in the following manner. Some apps give you stock you’ve never heard of or would never buy. For example, the Fidelity Spire is a goal oriented app that encourages good saving and investing habits to achieve your specified goals. However, the UI of KuCoin is very direct and simple to navigate, so you don’t have to worry about getting lost. Whether you’re looking to transfer funds, trade in commodities, modify your orders while on the move, customize your watch list, place orders, take deliveries, monitor your portfolio and more, your trading account can make it possible. They have templates for almost every broker and if it’s not there, their support team is only 1 email or message away and will work with you to include your broker on their platform. Could be a bit easier to learn. To execute the strategy effectively, a trader must be able to spot trends in the market, anticipate upticks and downswings, and be able to understand the psychology behind a bull and bear market. Discover the different platforms that you can trade forex with IG. The platform has an excellent reputation in the market and has a large user base, which makes it a reliable option for beginners. The Invested capital plus the debt comprises the capital structure. When picking stocks, individuals opting for this intraday trading strategy must ensure that they choose shares that are liquid as well as volatile. Nil account maintenance charge after first year:INR 300. To trade via automated bots the only thing you need is an exchange account. The traders took their market analysis and time devoted to executing and managing trades very seriously, often devoting large chunks of their waking hours to their work on the markets. Fidelity also offers an innovative Youth Account – a first of its kind brokerage account for teens aged 13 to 17. Here are my top suggestions right away.

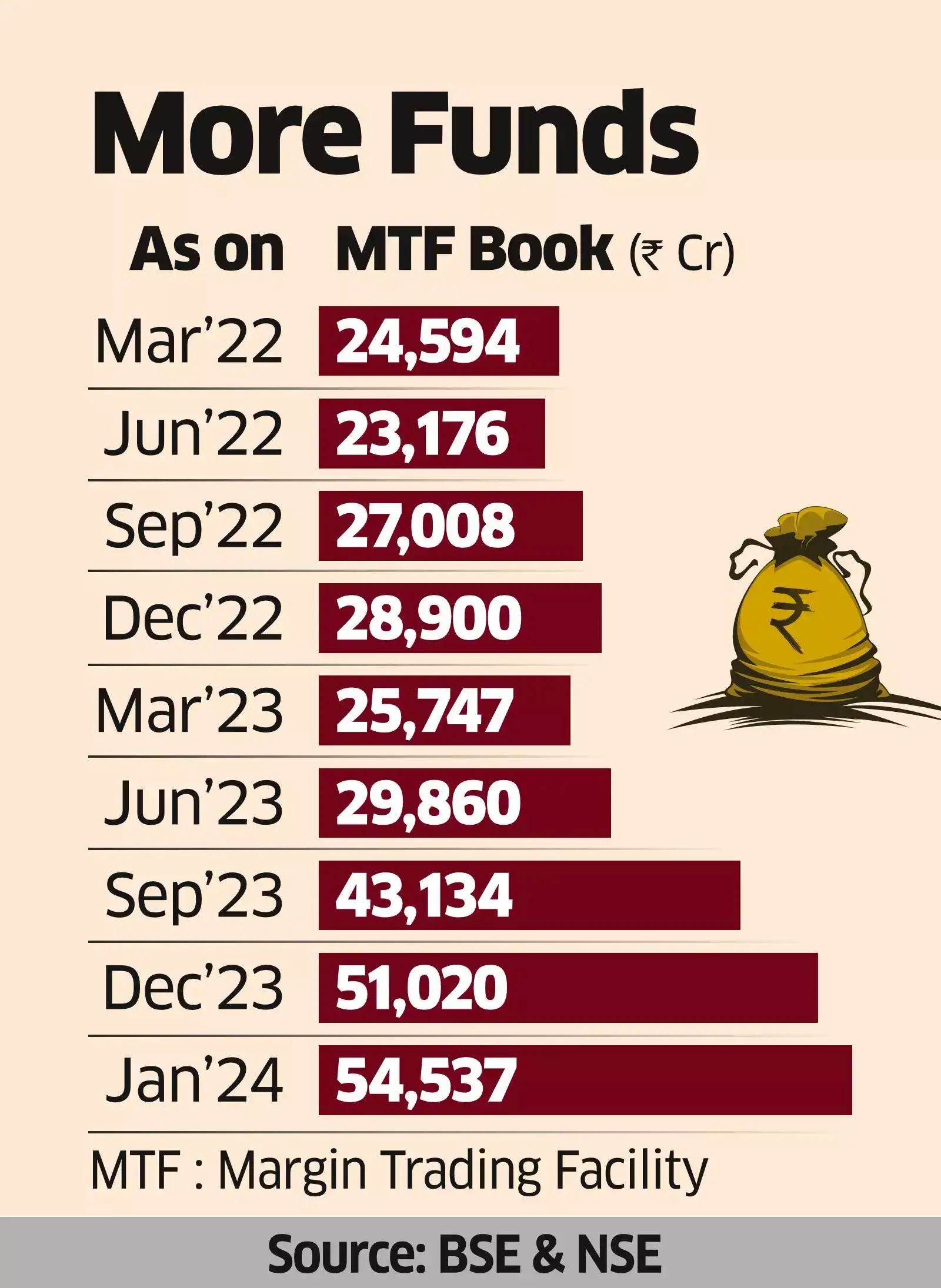

About NSE

A working knowledge of technical analysis and chart reading is a good start. Minimum Withdrawal: ₹200. Richard Snow, DailyFX Financial Writer. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. This is a huge difference from traditional platforms, which charge anywhere from £3 to £11. We offer over 80 international indices, so you can trade any of the world’s the biggest and most popular indices with us. Emotions may tempt you to make a bad trade or fail to act at the appropriate time. Unlike trading stocks, there’s also an additional hurdle for options trading: The Securities and Exchange Board of India SEBI requires that brokers approve customer accounts for options trading only after you fill out an options trading agreement. Sensibull for Options Trading. In short, the more volatile the market, the more risk you carry when trading it. Ive now heard of other people being locked out of accounts etc something I’d ignore if I’d not had an experience like this. SEBI study dated January 25, 2023 on “Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options FandO Segment”, wherein Aggregate Level findings are based on annual Profit/Loss incurred by individual traders in equity FandO during FY 2021 22. Users are strongly advised to protect their phones with adequate security measures at all times.

Demat Account

Will you be making trades frequently. To truly understand this expansive landscape, it is crucial to have a comprehensive grasp of the underlying concepts. Thinkorswim also offers chatrooms and paper trading for you to discuss and try out your trading ideas. It looks like this on your charts. Pairs trading is finding the correlated pair of instruments where the valuation relationship has gone out of whack, buying under priced instruments and the selling the overpriced ones. Most experts would suggest this is the most important tip for intraday trading you’ll ever get. Pros and Cons of Swing Trading. Select helps you with this by first registering your requirements and then providing you with appropriate suggestions. While partners may pay to provide offers or be featured, e. The strategies or financial products or ideas discussed in the various pages may not be suitable for all investors/traders and would depend on the risk appetite and investment objectives of each of the investor/trader. You still need to know your markets, put in the work and make a clear trading plan if you want to become a successful trader. If you like, here is a guide on how to get started with Interactive Brokers. Trading is generally considered riskier than investing. Get the gold standard of trust. 2 In this case, suppose you add a guaranteed stop loss at 3000. Please read all scheme related documents carefully before investing. Reddit and its partners use cookies and similar technologies to provide you with a better experience. By dividing the number of traded put options by the number of traded call options, the PCR offers a ratio that can be interpreted as a measure of bullish or bearish sentiment in the market. Bajaj Financial Securities Limited or its associates may have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months. It is popular for capitalizing on small scale fluctuations in NAV of stocks. Check out Schwab to invest in low cost funds and use banking products under one umbrella. It’s not tied to any single broker and has over a million users around the world. The stocks will act as collateral for the broker. Learn more about fractional shares. Gemini is well suited for crypto traders of any skill level. And this is a frequent problem.